VII. AIRPORT CAPITAL FINANCING REQUIREMENTS MUST BE MET

A. Recommendations

- Airport Improvement Program (AIP) funding serves as the linchpin of airport financial

planning and therefore, must be funded adequately on a reliable basis. The Commission

recommends that AIP contributions to airport capital requirements should be funded at $2

billion annually over the next five years assuming growth adjustments through this period.

Further, AIP should-be provided requisite budget treatment to ensure a stable and

predictable Federal funding source for airport capital development.

- The Commission recommends that Congress look to AIP and Passenger Facility Charges

(PFCS) as sources of additional revenues to finance future airport capital needs. This

recommendation is made reiterating the Commission's very strong belief that all elements

of this report on aviation financing are viewed as a comprehensive package and not as

individual parts to be implemented piecemeal.

- The Commission also recommends that smaller airports receive funding at a higher level,

so that their capital development needs can be met and thereby allowing them to continue

serving as a critical element of the air transportation system. The Airport Improvement

Program is essential for capital development at smaller airports as they have less

capability to draw in a meaningful way from other sources of capital funds.

B. Background

The Commission was encouraged by its enacting legislation to consider airport

infrastructure needs for airports of all sizes, and to provide recommendations on funding

alternatives for airport capacity development. To assist the Commission in this effort,

the Federal Aviation Reauthorization Act of 1996 requested that the General Accounting

Office (GAO-Airport Development Needs, April 1997) and an independent entity (Coopers

& Lybrand LLP-Independent Financial Assessment, February 1997) provide independent

assessments of future airport development capital needs. The Commission reviewed and

considered these studies and notes that both entities reviewed previous airport capital

requirement studies, which contained different underlying assumptions and hence

conclusions as to the total estimated needs over the next five years.

The Commission agrees with GAO and Coopers & Lybrand that there are several key

reasons for the differing assessments of airport capital requirements: incompatibility and

purpose of collected data, availability of data, and the underlying premise of the data

collection process. There are also significant differences in terms of time periods, AIP

eligibility, and data sources. In its report, Coopers & Lybrand estimated that the

average annual capital requirements total for 1997-2002 will be $7-8 billion per year in

constant 1997 dollars. In its report, GAO created four separate models to create an

estimated range of $1.4 billion to $10.1 billion per year from 1997-2001. While not

resulting in a single agreed upon estimate of needs, the Commission notes that these

reports all confirm that airport needs are significant and are expected to increase due to

emerging new requirements and forecast growth in airport operations. Current airport

revenue sources have not provided the funding to meet the needs identified in the Coopers

& Lybrand and GAO reports.

| Funding Source |

1990 |

1991 |

1992 |

1993 |

1994 |

1995 |

1996 |

| Airport Revenue Bonds |

54.600 |

$3.200 |

$4.800 |

$1.600 |

$3.000 |

$3.200 |

$4.000 |

| AIP |

$1.425 |

$1.800 |

$1.900 |

$1.800 |

$1.690 |

$1.450 |

$1.450 |

| State/Local Grants |

$0.500 |

$0.500 |

$0.500 |

$0.500 |

$0.500 |

$0.500 |

$0.500 |

| PFC's |

N/A |

N/A |

$0.085 |

$0.485 |

$0.849 |

$1.046 |

$1.113 |

| Total |

$6.525 |

$5.500 |

$7.285 |

$4.485 |

$6.039 |

$6.196 |

$7.063 |

Figure 8.

Sources of Airport Capital Financing*

(in $ billions)

* Does not include General Obligation bonds or airport

operating revenue.

The Commission examined the FAA's AIP requirement level of $1.7 billion, an estimate

derived from historic appropriation levels and budget constraints. While the FAA states

that at this level, it is able to fund most safety, security, rehabilitation, standards

and capacity projects, the Commission does not agree. At such a level of annual funding

the FAA has not provided single-year AIP grants for all high priority capacity projects

and noise mitigation projects that were ready for construction. The FAA acknowledges that

at less than a $2 billion level it cannot satisfy all requests for worthy noise mitigation

projects and multiyear letters of intent (LOI) that have been requested for capacity

projects important to the national system of airports.

The Commission believes that a $2 billion annual AIP should serve as the minimal

Federal investment level in airport infrastructure, and that this amount should be made

available on a reliable and predictable basis. Funding at the $2 billion level would

accomplish the following:

- There would be increased preservation of airport infrastructure at smaller airports that

are dependent on federal aid. This is especially important at general aviation airports

which largely use funds to improve safety and bring existing infrastructure up to

standards. There would also be more funding for capacity projects at reliever airports

- More safety and security projects could be funded at airports of all types and sizes.

Legislation enacted last year requires smaller airports served by commuter type operations

to meet higher safety standards consistent with those that airports serving larger

aircraft meet. AIP will be the principal source of funds to meet these standards. Security

expectations of the public can also be expect to drive further standards in this area.

Higher AIP will be a primary source to meet any new objectives for security.

- While there have been tremendous achievements in noise mitigation near airports,

millions of people living in areas near airports still experience noise levels that are

incompatible with residential usage. The noise funding set aside was cut last year based

on lower funding assumptions. If a higher funding level were achieved, noise mitigation

through AIP could achieve much more environmental benefit and timely results.

More AIP funding will result in more system capacity being developed. With higher AIP,

substantial progress can be made at meeting these needs. For large airports, further

commitments in the form of Letters of Intent (LOI -- a multi-year commitment or promise by

the FAA to fund a large project at a particular airport) could be made. These commitments

are typically for projects that will have a significant system-wide impact. There are over

$2 billion in pending LOI applications. With a higher AIP funding level, a more

significant improvement in overall airport capacity could be achieved.

The Commission notes that this $2 billion AIP level is less than the current authorized

level for AIP in existing law. This recommendation is based on the requirement to balance

capital spending, of federally collected taxes and fees between air traffic control and

airport needs, and the recognition that airport capital funding has a second

federally-authorized revenue source in PFCS.

In addition to considering needs assessments, the Commission also examined actual

airport capital spending from all known sources of airport capital financing: airport

revenue bonds, AIP, State and local grants, and Passenger Facility Charges (PFCS) (but not

including other potential revenue sources more difficult to quantify, such as that portion

of an airport's operating budget which may finance small capital projects). In examining

these revenue sources, the Commission makes the following observations and conclusions:

- From 1990-1996, total airport capital spending from "known" sources ranged

between $4.5 billion and $7 billion and averaged approximately $6 billion per year.

- Of this total, the principal source of capital for airport development at large and

medium hub airports was airport revenue bonds. On average, the Commission notes that

airport revenue bonds accounted for $3.5 billion a year in "new money", and an

additional $1.6 billion a year in "refunding" or debt restructuring designed to

enable future borrowing or to reduce airport related costs to users. Further, the

Commission additional (sic) $1.6 billion a year in "refunding" or debt

restructuring designed to enable future borrowing or to reduce airport related costs to

users. Further, the Commission notes that this level of bond financing has persisted, on

average, even with the advent and expanded use of PFC revenue.

Between 1992 and 1996, the AIP program has been reduced from $1.9 billion to $1.45

billion, a 23% drop-off. This has tremendously eroded the effectiveness of this program to

meet airport infrastructure requirements. Looked at another way, the proportion of the

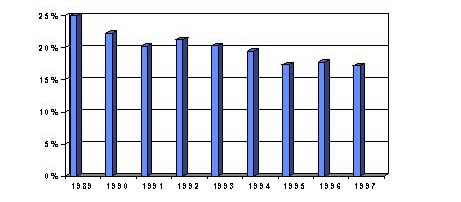

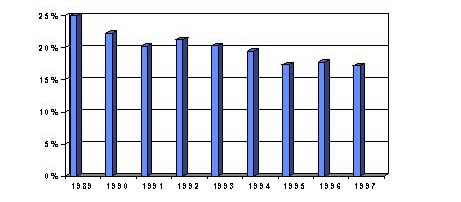

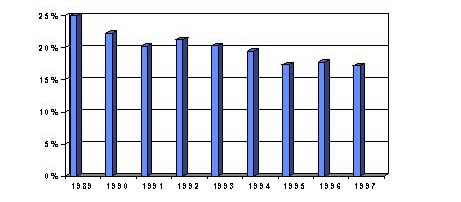

FAA's budget that goes for airports has declined precipitously. The following chart

illustrates the relative decline in the airport program compared to the rest of the FAA's

activities and programs. Aside from fiscal impact on airport development, this is a very

strong policy statement about priorities. It is one that the Commission strongly opposes

and believes should be reversed.

Figure 9.

AIP as Percent of FAA

Appropriations

- Since 1992, PFCs have provided an important new financing option for airport capital

development, generating over $1.1 billion annually. Airports and airlines have generally

agreed with the majority of proposed PFC financed projects. In those cases in which

airlines register disagreement, most often landside related development has been proposed.

The Commission recognizes that untapped, annual PFC authority of approximately $500

million exists at certain large and medium hub airports, as well as an additional revenue

potential of $60 million per year at certain small commercial service airports. However,

untapped PFCs represent potential local resources which may not presently align with where

the capital needs are in the airport system. Even if fully utilized, current PFCs are

insufficient to satisfy unmet infrastructure requirements.

- In 1990, Congress, when considering all sources of airport revenue, determined that

airport infrastructure requirements could best be met by granting airports PFC authority

of up to $3 per passenger, and by increasing AIP spending to $2 billion a year or higher.

Yet, since 1993, AIP funding has steadily declined, to the extent that in 1997, a gap of

over of $800 million exists between AIP authorized and appropriated levels.

C. Other Recommendations and Findings

- Airport revenue bonds are the single most important financing tool available to large

and medium airports. These airports boast an unbroken record of creditworthy financial

performance, earning the status of premium-grade investments in the exempt municipal bond

market. Preservation and potential enhancement of the tax exempt status of this financing

tool is essential to meeting the capital demands of large and medium hub airports.

- Considering the Commission's recommendations for higher AIP funding, it recognizes that

Letters of Intent (LOIs) are an effective innovative financing technique and recommends

that the use of LOIs should be continued and concentrated on projects which increase

airfield capacity. Further, the FAA should maintain and strictly enforce existing

requirements that LOI proposals be subject to rigorous cost benefit analysis, as well as

an affirmative determination of system benefits.

- In addition to LOIs, the Commission examined other innovative financing techniques and

alternatives. The Commission concludes that innovative financing options, such as

revolving loan programs, loan Guarantees, and various credit enhancements, offer, at best,

marginal and limited opportunities to leverage Federal funds or to increase total airport

capital development spending. This is because the essential elements of innovative finance

have long been institutionalized at large, medium and small airports capable of borrowing.

Airports not capable of borrowing generally rely on local subsidies to meet operating

expenses and Federal support to meet capital requirements. With regards to airport

privatization, the Commission believes that the results of the current congressionally

mandated pilot program should be analyzed before any conclusions are reached on the

additional statutory or policy changes.

- In order to meet the needs for airport infrastructure investment, the Commission

recommends that, in the future, the current $3 ceiling on PFCs will need to be raised. As

an alternative, AIP levels would need to be funded at a level substantially above the $2

billion annual level recommended in this report. If Congress decides to increase the PFC,

the Commission recommends that there be a process established that places a strong

emphasis on negotiation between local airports and tenant airlines when a higher-than-$3

PFC is being proposed. When a higher-than-$3 PFC is proposed, the Commission recommends

that when there is written agreement between an airport and its tenant airlines for the

airport to levy a PFC higher than $3, there should be no statutory PFC dollar limit, and

the FAA's approval process should be ministerial. The Commission recognizes the fact that

the airport and airline industry groups have very strongly held and, at times, differing

views on the matters of when and how such an increase should take place. Those matters

will still require resolution in the context of comprehensive airport funding legislation.

Therefore, the Commission's legislative proposal only includes a "findings"

statement on the need for a general PFC or AIP increase to meet significant airport

capital needs to accommodate growth. Again, this recommendation is made in the context of

the overall financing report of the Commission being treated as a total package and not as

elements to be separately implemented.

- The Commission stresses the need for treatment in the federal budget process of the AIP

so that it can be a steady, dependable and reliable source of airport capital development

funding.